EU member states have agreed to fight tax evasion by forcing tax intermediaries like accountants and lawyers to report their illegal activities.

Sounds feasible to you? We will have to wait until 2020 to know fore sure: the agreement won’t come into effect until three years after it was initially proposed.

Needless to say, three years is a lot of time. It gives any big for-profit entity sufficient time to move their money around, establish shell companies, and evade the regulators.

But even if tax evasion stopped tomorrow — and all firms were properly taxed — European citizens would still not know where the money goes. The failure of transparency inside EU institutions is not only undemocratic — it also hurts the legitimacy of the EU’s quest to crack down on tax evaders.

Europeans urgently need transparent, efficient, and EU-wide mechanisms to fight tax evasion. But they also need faith that their taxes are distributed fairly across the continent, whether through a Universal Basic Dividend or through supporting education. For this, we collectively develop a progressive agenda for Europe, a European New Deal!

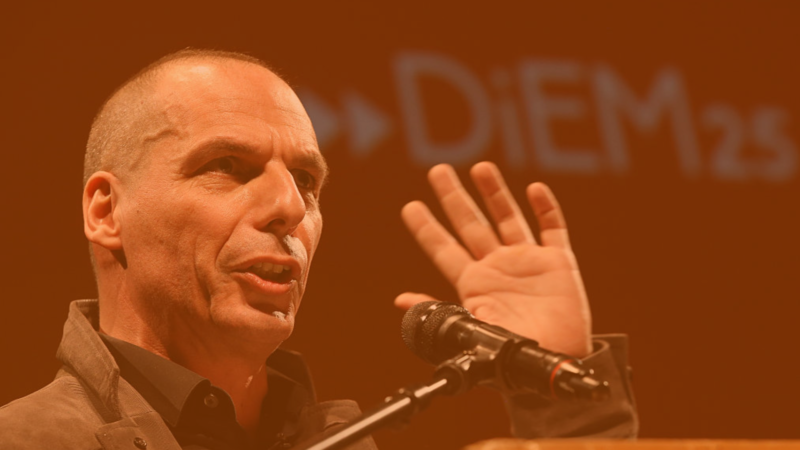

Aris is a member and volunteer of the DiEM25 movement.

Do you want to be informed of DiEM25's actions? Sign up here