The 24th Conference of Parties of the UNFCCC concluded in Katowice, Poland, on December 15. Its goal was to hammer out the details of the 2015 Paris agreement.

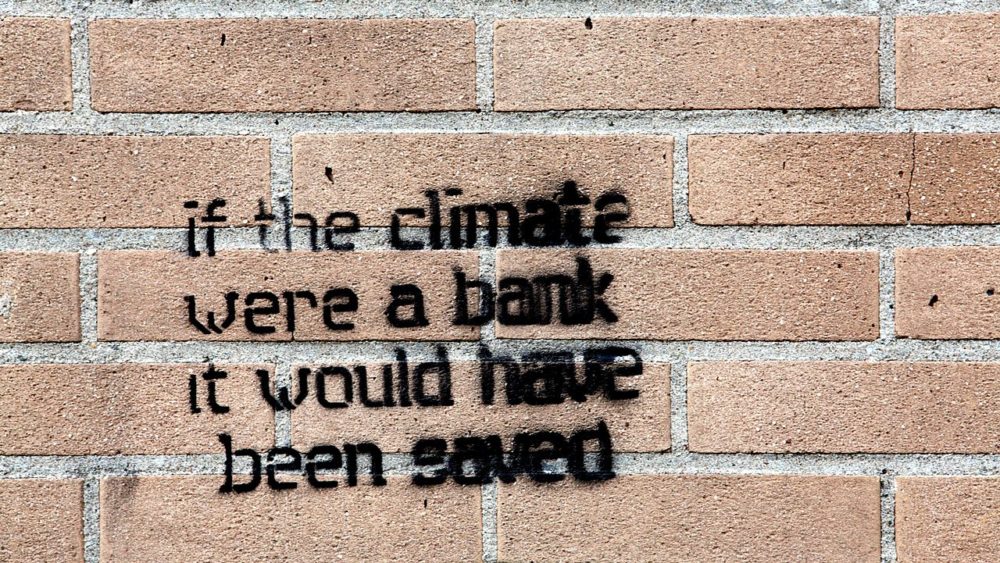

But far too little was achieved — and with climate destruction on the horizon, Katowice will mostly be remembered for the common “rulebook” of procedures and guidelines that delegates adopted there.

Indeed, current commitments (for GHG emissions reduction) are woefully inadequate for achieving the agreed Paris goal of keeping global warming below 1.5 to 2ºC. The urgent need to ramp up commitments was merely hinted at in Katowice. And the possibility of meeting even current commitments remains remote.

Major stumbling blocks

Ineffective mechanisms

Emissions reduction mechanisms are mainly of two types: Fee & Dividend (F&D) and Cap & Trade (C&T).

The F&D approach consists of a rising carbon tax, with the revenue redistributed to all citizens. It is more cost-effective and efficient than C&T. And unlike C&T it applies across the board, is not prone to lobbying by industry or profiteering by financial services, and is pro-poor. Yet governments, driven by powerful lobbies, are pushing C&T despite its utter inefficacy, inherent instability and loopholes.

Commitments not legally binding

There are no penalties for non-compliance¹ and emissions have actually been rising in countries with voluntary commitments.

Equity concerns

The principle of Common but Differentiated Responsibility and Respective Capacities — or CDRRC — was omitted from the “rulebook”. Based on the huge differences in responsibility for climate change as well as capacity to combat its consequences, CDRRC calls for larger cuts from the largest historical emitters and assistance for adaptation and mitigation in poorer countries.

The Bottom Line

Carbon-free energy needs to be made cheaper than fossil fuel without burdening the weak. This is what DiEM25 and European Spring propose, for a 65% reduction in GHG emissions by 2030:

- In line with the F&D approach, a pan-European carbon tax paid into a European Equity Depository, redistributed to all citizens as part of a Universal Citizens’ Dividend

- In line with CDRRC the carbon tax would be based on the country’s Human Development Index. It would be lower in poorer countries, and they can generate additional revenue from export taxes

- Phasing out Europe’s fossil fuel subsidies (estimated at €112 billion per year) to make carbon-free energy relatively cheap and (along with other fiscal measures) generate funding for the green transition

- Redirecting CAP (Europe’s Common Agricultural Policy) subsidies to sustainable farming practices to reduce emissions from agriculture

¹ However, a recent legal precedent in the Netherlands offers hope, if repeated in larger countries.

Do you want to be informed of DiEM25's actions? Sign up here