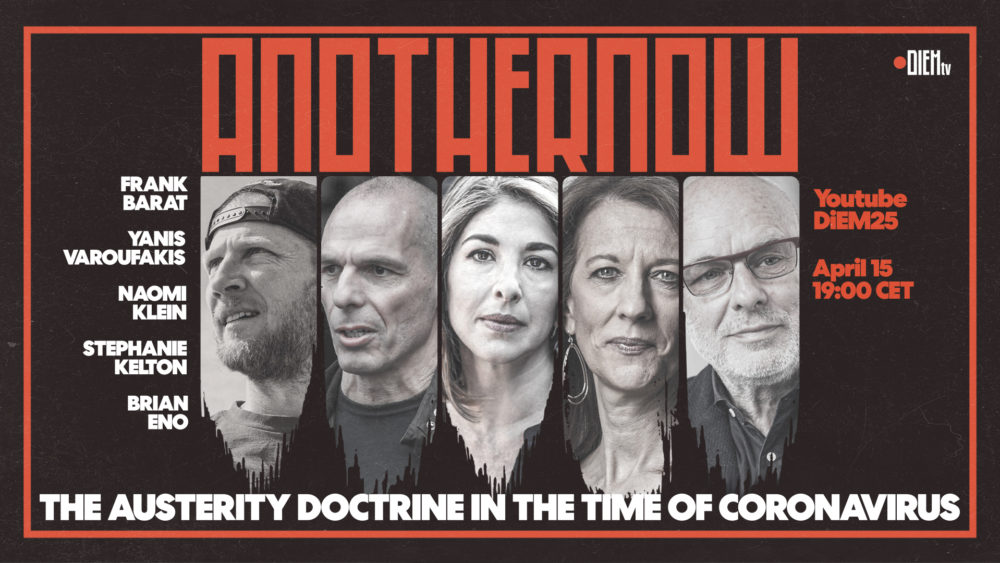

In the third episode of Let’s Talk It Over, Naomi Klein, Stephanie Kelton, Yanis Varoufakis, Brian Eno and Frank Barat discuss what impact the coronavirus crisis as had on the world economy and how it has been used to further entrench world inequality.

Here are some of the questions tackled in the program:

- Austerians for years told us that all hell would be unleashed on us if the government spent a little more. But, during the pandemic the same politicians/bureaucrats printed trillions. Where did all that government money come? Does it need to be repaid via higher taxes

- Has the pandemic ended the reign of austerity as policy and mindset?

- Or is austerity lurking in the shadows of the various stimulus plans, ready and willing to continue its destruction of human prospects and ecosystems?

And here are some basic points that everyone must grasp regarding austerity:

What is austerity in practice?

It is a policy of cutting government spending as a means to reduce the budget deficit so as to slow down the built up of public debt – or even to run budget surpluses in order to reduce it.

What is the fallacy on which austerity policies are founded?

The failure to recognise that, unlike a person, family or company, the government cannot bank on its income being independent of its spending. You and I, if we choose not to spend money on new shoes, will keep that money. But not the government. If the government cuts spending during periods of falling private spending, then the sum of private and government spending will decline faster. But this sum is national income. So, austerian government spending cuts mean lower national income and fewer taxes. Thus, unlike you and I, when the government cuts its spending during tough times it is cutting its income too!

What is austerity in essence?

Austerity is hidden class war and war against the environment. That’s what austerity is. Recall that austerians, whatever they say in words, are never against government spending as such – as long as the money is spent on the rich and the polluters (Republican tax cuts, money for weapons, subsidies for fossil fuels). No, their gripe is with money spent on the weak and on maintaining priceless values, like clean air or public libraries.

Why do the powerful adore austerity and despise public debt?

If you ask them, they will go on and on about the perils of inflation and the fear of public debt. While it is true that the rich do fear inflation, a force that eats into the real value of their mountains of cash, and while it is also true that they do not want to be taxed so that poor kids can have health care or a good education, there is another explanation of their love of austerity: they like austerity because they want little people to have as few survival options as possible.

Why? Marx has the answer here in the form of the lovely true story of Mr Peel. Back in the 1840s, sensing that a massive economic crisis was on the cards, Mr Peel bought a number of ships, filled them with food, seeds, equipment and 300 persons of the working-class, men, women, and children. But soon after their arrival in W. Australia, Mr. Peel’s plan was in ruins. What had happened? The transported labour force abandoned Mr Peel, got themselves nice plots of land in the surrounding wilderness, and went in ‘business’ for themselves. The workers’ access to alternatives meant that Mr Peel, though he took with him money, equipment and a workforce, could not take capitalism with him.

Capitalist bosses understand this. They and their political agents fear, above all else, that public spending may give the little people too many alternatives. The more alternatives they have the lower the capitalist class’s hold over them. It is the fear of losing power, like Mr Peel, that lures them to austerity – even when austerity-induced depression depresses the capitalists’ capacity to find customers. After all, when that happens, the powerful can always depend on the money tree, the central bank, to mint money for them – never, of course, for the little people.

In short, austerity helps the Mr Peels of the world reproduce themselves as capitalists.

Is austerity dead in the water in the time of coronavirus?

President Biden is pushing trillions of new government spending though Congress. PM Boris Johnson has distanced himself from austerity. Even the EU is paying lip service to the need to suspend austerity. Is this the end of austerity? Listen to Stephanie Kelton answer this crucial question… Meanwhile, note that the fact that government spends more during bad times does not necessarily mean that austerity is on hold. For example, if during this pandemic a previously austerian government only replaced lost incomes, yes, its spending went up but its fiscal stance remains one of structural austerity – in the sense that, the moment the pandemic passes, government spending goes back to its earlier stingy levels. If new investments are added to replaced incomes, yes, that would spell the end of austerity. In that sense, the jury is still out on Joe Biden and Boris Johnson – while it is clear that the EU remains stubbornly wedded to austerity.

Watch the full event below!

Do you want to be informed of DiEM25's actions? Sign up here