After a full decade of harsh austerity, the pandemic will now certainly deepen the Greek recession, which will in turn bring new austerity measures, perpetuating a vicious circle with no end in sight.

In the meantime, the vast majority of citizens are left to fend for themselves, facing one or more of the following: Growing unemployment or underemployment, prepayment of next year’s income tax, foreclosures of small business properties and even main residences, and the loss of numerous seasonal jobs and support incomes due to the sharp drop in tourist arrivals.

In response, MeRA25 has tabled a 60-page proposed bill that is in part common-sense (lowering taxes and using state property as guarantees to generate investment flows), in part innovative (creating a parallel payments system to bypass the local banks and having senior public servants elected by a committee constituted by way of sortition), in part radical (the international and local oligarchies will have none of the above) and on the whole, absolutely necessary!

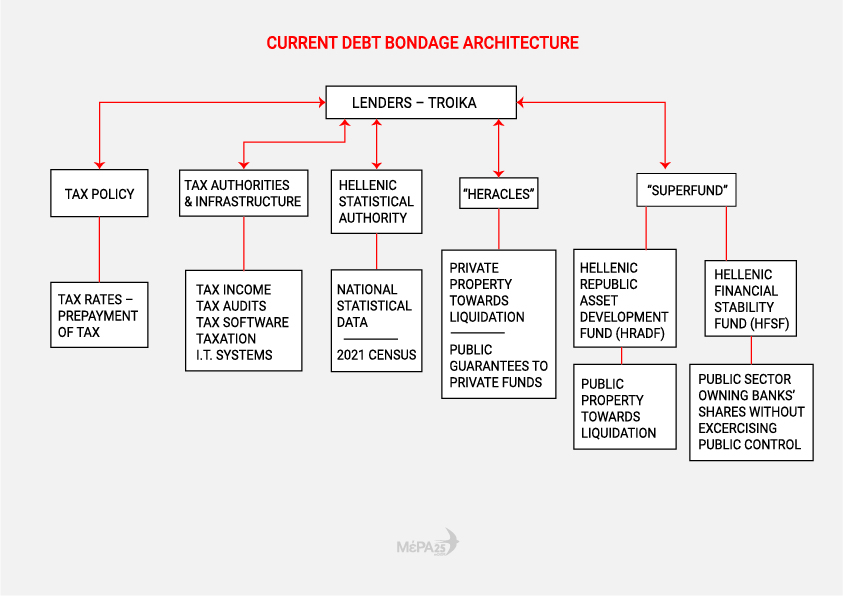

As things stand, the oligarchy without borders is holding Greek society hostage under a debt bondage scheme.

The lenders, in control of the Public Sector through the troika, excercise very restrictive fiscal and taxation policies, while international companies are pillaging publicly owned property through the “privatization program”. In the meantime, under the government plan “Heracles” to remove bad debts from banks’ balance sheets, offshore funds are acquiring red loans at huge discounts, allowing them to return handsome profits by auctioning mortgaged properties even well below their market value. At the same time, the government does not dare interfere with the banks, recapitalized using taxpayer money but still pursuing their vision as society’s parasites, despite the state owning a large percentage of their shares. On top of that, the local oligarchy continues to tax evade systematically.

This is the oligarchy without borders in action.

The state, under the control of the international oligarchy, turns a blind eye to the local oligarchy’s transgressions. In return, the latter ensure that the media under their control (that recently benefited from opaque government hand outs of EU funds for pandemic-related awareness campaigns) do not question the debt bondage regime. The government essentially acts as a middle man, ready to please both in return for support to stay in office.

According to MeRA25, the only way to protect citizens equitably is to regain national and popular sovereignty over tax authorities, the payments system, management of private debt, public property and the credit institutions that depend on public capital.

This way, the current pyramidic debt bondage architecture with the lenders at the helm can be transformed into a sovereign, institutionally decentralised structure under democratic control.

A translation of MeRA25’s press release follows:

MeRA25 on addressing the Economic Pandemic

Comprehensive Legislative Proposal for the Protection of Citizens

from the Fallout of the Intensifying Economic Crisis

Reclaiming Democratic Sovereignty over the institutional tools of the Greek Public Sector

Introduction: Prerequisites of citizens’ protection

Today, in the midst of a pandemic that threatens citizens with a second decade of debts, business closures, underemployment, agony, exploitation and loss of dignity, the Greek Public Sector is called upon to protect them.

In the last decade, the Public Sector lost control over important tools – from the ability to lower VAT and abolish the inane prepayment of tax, to managing its own property or protecting people’s main residence.

[prepayment of tax: In Greece businesses and professionals pay 100% of next year’s income tax in advance, based on the past year’s tax payment]

Irrespective of which party “governs”, the Public Sector must retrieve control over these tools in order to be able to protect its citizens from upcoming ills. This requires institutional reforms that combine:

- systemic haircuts of outstanding payments for the most vulnerable citizens and the lower middle class

- rationalization of existing institutions and creation of new ones

The comprehensive legislative proposal submitted to public consultation today by MeRA25 codifies the taxation policy and the far-reaching institutional changes that are necessary if the Public Sector is to protect citizens during the new, testing decade that is upon us.

Citizens facing the accelerating Debt-Recession crisis

As MeRA25 had warned, after two years of fictitious mini growth (2017-2018), the Greek economy returned in the second half of 2019 to a recessionary dynamic, which is its natural state of affairs (given the fourth austerity package 2018-2060).

[June 2018 Eurogroup decision: The Hellenic Republic (Greece) commits to achieving budget primary surpluses of 2.2% of GDP from 2023 until 2060]

The pandemic accelerated the existing recession, sinking national income by at least a further 15 percentage points in 2020 – while the family and personal incomes of the majority have been reduced much further. This recessionary resurgence leads, as a matter of mathematical certainty, to two outcomes:

- Deepening of the insolvency of both individuals (proliferation of non-performing loans) and the Public Sector (Debt to GDP ratio above 200%)

- New harsh austerity, equivalent to a 5th austerity package, made certain by committing to achieve a primary surplus (even a primary deficit less than 3% of GDP) in 2021

It is a foregone conclusion that the policies currently being followed, coupled with the simultaneous institutional inability of the Public Sector to react in favor of citizens will bring:

- new misery to the majority of citizens

- reinforcement of the feedback between insolvencies and recession

- further desertification, as our youth (especially the most educated) will continue to emigrate

MeRA25’s Legislative Proposal at a glance:

Today, a decade after Greece stopped being a sovereign country, the lenders, through the troika, continue to excercise full control over tax policy (eg. VAT, prepayments, corporation tax), tax authorities (PRIA), Greek statistical data (HSA), the fire sale of red loans to funds, which makes protecting main residences and the lower and middle class (HERACLES) impossible, and of course the troika Superfund, that forbids the Greek Public Sector to make use, for the benefit of Greek society, of both the public property (HRADF) and the banks’ shares that are in possesion of the state (HFSF).

[PRIA: Public Revenues Independent Authority, HSA: Hellenic Statistical Authority, HERACLES: The government’s plan to get red loans off banks’ balance sheets, by selling them at a huge discount to offshore predator funds, Superfund (Hellenic Corporation of Assets and Participations): a single umbrella fund established for the management and exploitation of all public property, whose subsidiaries include HRADF and HFSF, HRADF (Hellenic Republic Asset Development Fund): Manages the privatization of assets assigned to it through the “bailout” process, which include Companies (eg. public utilities, postal service), Infrastructure (eg. airports, ports, marinas, railways, highways, stadiums) and Real Estate (eg. prime public land, beaches, historical buildings), HFSF (Hellenic Financial Stability Fund): Recapitalizes banks by buying their shares.]

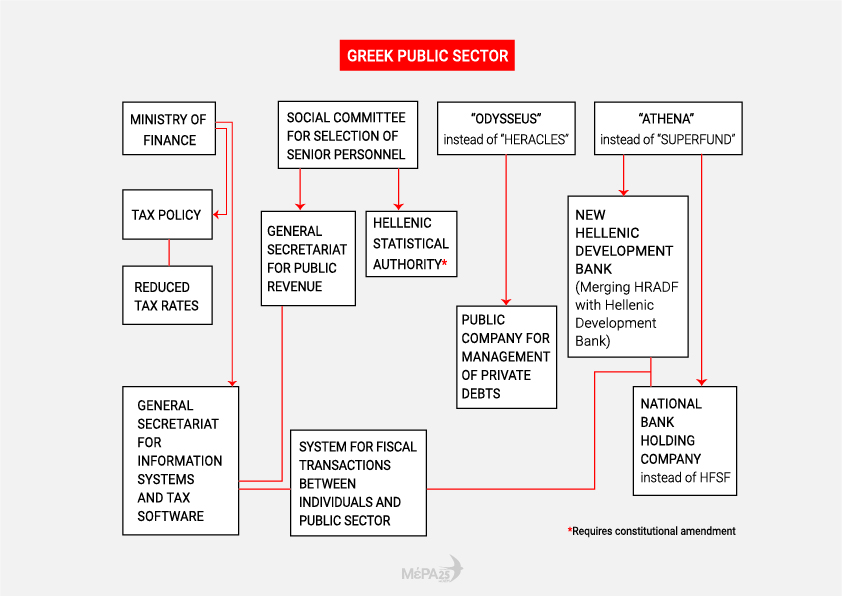

Legislating MeRA25’s proposed bill will overturn the recessionary dynamic of tax policy and, equally important, will replace the institutional architecture which is subservient to the troika, by reclaiming or creating institutions that protect citizens from the deteriorating debt-recession crisis.

- Abolition of all tax prepayments for annual incomes below 100 thousand euros (natural persons), as well as for businesses employing less than 300 people – Haircuts on outstanding payments owed by businesses and natural persons that where hit directly by the pandemic – Maximum VAT rate of 15% (18% for cash transactions) – Corporate tax rate of 15% for small companies, 20% for medium sized and 29% for large ones.

- The troika-controlled PRIA is abolished, with tax software and necessary IT systems transfered to a new General Secretariat for Information Systems & Tax Software.

- Establishment of a new, autonomous General Secretariat for Public Revenue, whose General Secretary will be selected by neither the government nor the lenders. Instead, they will be elected by a Social Committe for Selection of Senior Personnel, 1/3 of which is comprised of parliamentarians, 1/3 by judges selected by sortition and 1/3 by tax professionals – accountants selected by sortition.

- “Heracles” is abolished and replaced by “Odysseus”, a new regime for managing red loans with a new Public Company for Management of Private Debts at its center – see also previous Legislative Proposal by MeRA25.

- The “Superfund” is abolished and replaced by the company “Athena – National Development Company for Public Property and Fiscal Transactions”, comprising of

- the National Bank Holding Company, that will replace the defunct HFSF

- the New Hellenic Development Bank, that will result from the merger of HRADF with the existing development bank, so that the public property that is now being sold off by the HRADF is utilised instead (not sold) as a guarantee to induce investment flows in the private and public sectors.

- New System for Fiscal Transactions between Individuals and Public Sector, offering degrees of fiscal freedom to the Public Sector, while at the same time guaranteeing tax exemptions for citizens, as well as free of charge transactions with the Public Sector and between individuals.

Do you want to be informed of DiEM25's actions? Sign up here